The RBI has introduced an electronic authentication system called Positive Pay that will allow customers to share cheque details with the bank before the bank processes it. This additional security layer is meant to address the rising instances of cheque fraud that have made headlines throughout the past year.

Before customer issue a cheque, Customer need to share cheque details like name of the payee, issue date, amount and send it to bank via Mobile banking or Internet Banking. When the cheque is presented to the bank for payment via CTS clearing, the bank will compare the instrument details received against the details you send. In case of any mismatch, the bank may review it for suitable action.

Indore Paraspar Bank is fully aware of the risk posed by cheque fraud. Hence, we have put into place a robust process that is fully compliant with RBI guidelines. However, not all cheques will need to undergo verification via Positive Pay. We recommend this process for cheques with a value of Rs 5, 00,000 and above.

1) Cheque details need to be submitted via mobile banking or Internet banking at least 24 hours before the cheque is presented for clearing.

2) Customer will have to inform bank following details with mobile banking or Internet banking:

a. Account number from cheque is issued

b. Cheque number

c. Cheque issue date

d. Cheque amount

e. Name of the payee/Beneficiary name

f. Cheque front and back images.

3) Customers are advised to feed correct details of the cheque including correct spelling of payee’s name and the exact amount of the cheque to the Bank for successful positive pay confirmation. There is no option for Modify/Delete confirmation in any mode because modification could not take place once the data will be submitted to NPCI. Bank will not be responsible for any incorrect information provided by a Customer.

4) In case of mismatch in details on the cheque with the details uploaded under the PPS system, if otherwise in order viz. sufficient funds, signature match etc., Bank shall, at its sole discretion, return the cheque at the sole risk, responsibility and liability of the Customer.

5) If no data is uploaded under Positive Pay System by the Customer, such cheques issued will still be cleared in a normal mode as per extant guidelines. However the account holder shall be solely responsible in such cases for any discrepancies and will not be able to raise any dispute over any undue clearance or return and the Bank will not be liable for any such development.

6) Cheques presented in Clearing are validated as per the regulatory guidelines defined for CTS Clearing. PPS system is an additional tool for validation of cheques. All other parameters with respect to validation of Cheques remain unchanged.

7) The Bank shall not be responsible for any losses or delays which may be caused by any circumstances beyond its control, or for any act, omission, neglect, default, failure or insolvency of any correspondents, agents or their employees or any third party systems.

Login into Indore Paraspar Bank’s e-banking portal: https://ipsbonline.co.in/ebanking/

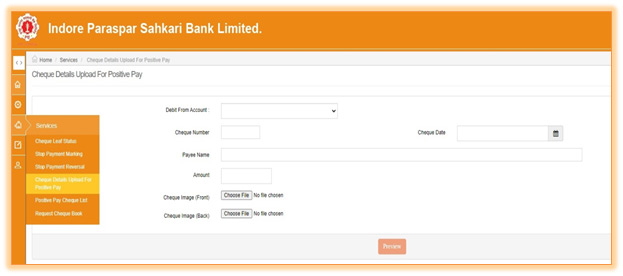

For submission of PPS data, go to Services -> Cheque Details Upload for Positive Pay

On the PPS request entry page fill the cheque/instrument related details.

a. Select cheque issuing account Number from the drop down

b. Cheque number

c. Cheque amount

d. Name of the payee/Beneficiary name

e. Cheque issue date

f. Upload Cheque front and back images by clicking on upload button. Before uploading Please keep copy of cheque front and back scanned image on of your PC/Laptop.

Click on submit button Internet Banking validates cheque status, cheque should be unused. For multiple cheques, separate Positive pay entry is to be done for each cheque.

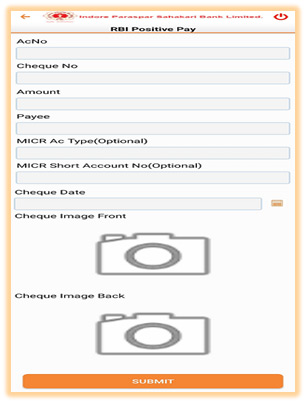

Login in to Indore Paraspar Mobile Banking App.

For submission of PPS data, click on (Request/Utilities) Menu on the dashboard then click on the "RBI Positive Pay" option.

g. Select cheque issuing account Number from the drop down

h. Cheque number

i. Cheque amount

j. Name of the payee/Beneficiary name

k. Cheque issue date

l. Upload Cheque front and back images by clicking on icon.

m. Click on submit button

If cheque details are valid, successful message will be displayed on the screen.

For multiple cheques, separate Positive pay entry is to be done for each cheque.